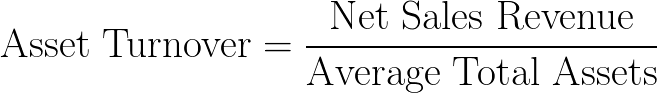

Your sales revenue has gone up, but the total sales turnover ratio has gone down. Now, let’s say you haven’t made any big purchases. In broad terms, have those investments paid off? Should the following year’s ratio be higher, it might be evidence that they have. For example, you could do the calculation just before you make several investments in new equipment. Total Asset Turnover Ratio = 5.3 times What does this tell you?įor a small business, the total asset turnover ratio (like other similar ratios) really comes into its own when you compare one year’s figure to the next. This is expressed as a ‘number of times per year’.

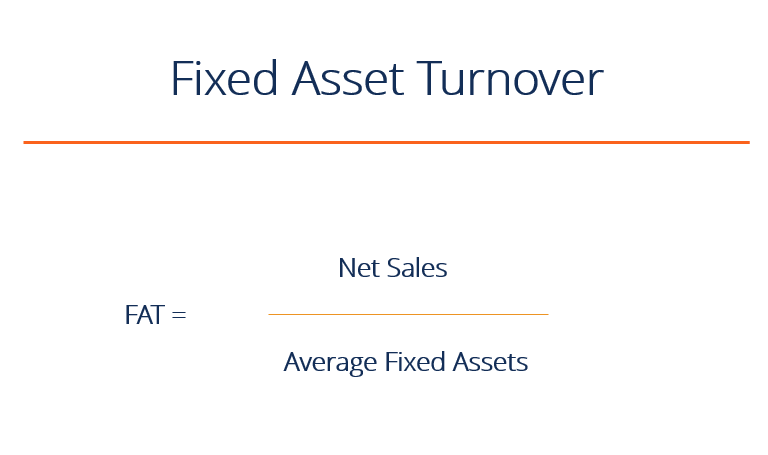

Divide your sales figure by net assets to give your total asset turnover ratio.These liabilities are likely to include money owed to suppliers, loan repayments due within a year, and your outstanding tax bill – discount long-term liabilities such as loan capital due to be repaid after a year as these fall out of the period we are calculating. You arrive at this figure by dividing the value of current liabilities by total assets. the calendar year), make sure that you take sales figures for that period only- don’t inadvertently apply the sales figures for the previous tax year, for example. For accuracy, if you are calculating the ratio for the year ending 31 st December (i.e. Calculate your annual sales figure for the same period.Add these figures together and divide them by 2. Subsequently, go back to 1 st January and look at the net value of your assets on that date. Calculate the value of your assets on that date. Let’s say you are making the calculation on 31 st December. If possible, calculate your average total value of the assets for the period in question.Following this, include all current assets such as money owed by customers and money held by your business at the bank. The current net book value of these assets is applied, for example, after depreciation. For the purposes of this calculation, include not only tangible fixed assets, such as machinery and equipment, but also intangible fixed assets, such as patents, trademarks, and goodwill. Start by identifying and calculating the combined value of all of the assets within your business.This can help you assess how everything within your business is being put to work to generate sales. We’ll start with the big picture, by looking at a relatively simple calculation.

#Total asset turnover formula how to

So, here’s how to do the maths, and what the outcome of your calculations might tell you about your business. This may sound daunting, but step by step, it’s really quite straightforward. With the help of asset turnover ratios, you can start to find answers. Your assets are key to this: machinery, equipment, company van, stock, cash, and even your office chair. Is your business making the best possible use of its resources? Is what you’re getting out of your business increasing in line with what you’re putting in?

0 kommentar(er)

0 kommentar(er)